Have you seen your home insurance rates increase? One reason for this change: rising home repair costs.

.png?width=940&height=788&name=BM%20ROOF%20REPAIR%20AFTER%20WIND%20AND%20HAIL%20DAMAGE%20(3).png)

The cost of labor and construction materials has increased dramatically in the last five years due to inflation. This affects your insurance price because if you were to have a claim and needed to rebuild parts (or all) of your home, it would be MUCH more expensive to do that today. Insurance carriers would in turn be paying higher amounts to you when you file your claim.

With the continuous increase in rebuilding costs due to inflation, homes now require higher dwelling coverage limits to align with these escalating prices. This results in a rise in home insurance rates.

Here are some of the biggest factors that have increased to these rising repair costs:

1. More frequent weather events than ever before.

2. Costlier building materials.

3. Labor price increases.

4. Assertive and competitive contractors.

5. Supply chain disruptions and delays.

6. Open flood plans and multi-story constructions.

You can learn more about these in our blog post, "Why did my home insurance go up" here.

What it looks like in real numbers.

Check out these staggering statistics from our partners at Grange Insurance:

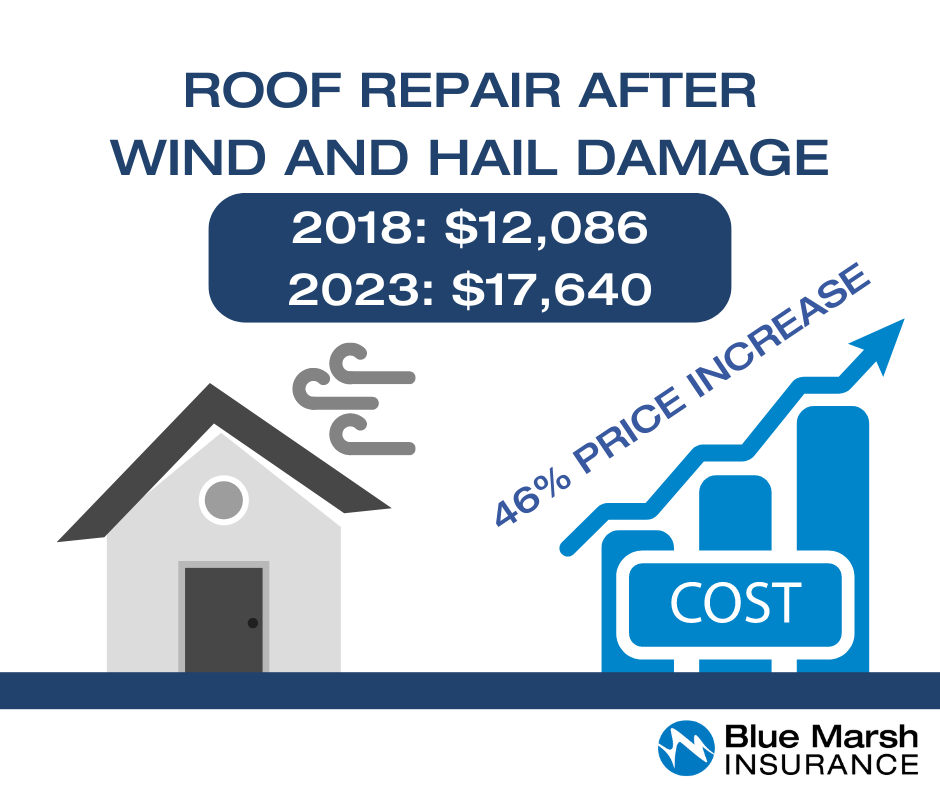

1. Roof repair after wind and hail damage has seen a 46% price increase in the past 5 years.

2. Large fire damage restoration has seen a 33% price increase in the past 5 years.

.png?width=940&height=788&name=BM%20ROOF%20REPAIR%20AFTER%20WIND%20AND%20HAIL%20DAMAGE%20(1).png)

3. Non-weather-related plumbing repair has seen a 50% price increase in the past 5 years.

.png?width=940&height=788&name=BM%20ROOF%20REPAIR%20AFTER%20WIND%20AND%20HAIL%20DAMAGE%20(2).png)

In addition...

The price of single-family residential home construction materials have climbed 33.9 percent since the start of the pandemic, while trade services are up 27 percent.

The numbers speak for themselves. The escalating costs of home repairs over the past five years have undoubtedly had an impact on your home insurance premiums.

So what can you do?

While it can feel like many of these things are out of your control, there are things that you can personally do to help lower your insurance bills.

- Get your policies coordinated. Do you have all of your polices with one agency? If not, you could be missing out on discounts. Coordinating your policies is one of the easiest ways to save money!

- Schedule a time to have a policy review with your agent. This ensures that your coverage is up-to-date and that you are receiving every possible discount.

- Consult your agent before filing a small claim. In some cases, it might be better option for you to absorb the cost instead of filing a claim. Need help deciding if you should file a claim? Check this out.

We know that no one likes to see their rates increase. We are here to help. Give us a call at 610-590-0152 if you’d like us to review your policies.

A little more about Blue Marsh Insurance...

When he founded Blue Marsh, Tom Davenport wanted to create a different kind of insurance company. One that’s built on personal relationships and a local presence. One where you, the customer, feel more like a friend.

As an independent insurance agency, Blue Marsh Insurance represents a carefully selected group of financially strong, reputable insurance companies. Therefore, we are able to offer you the best coverage at the most competitive price.

If you’re interested in starting a quote online or having us take a look at your current policies, click here!